As of March 2025, the tokenization of real-world assets (RWAs) is steadily carving out a place in DeFi.

The idea has been around for a while, but it’s picking up speed now, with estimates suggesting it could grow into a market worth $30 Trillion, maybe even $100 Trillion someday.

More key stats:

Market projected to reach $50 billion by year end, following 32% growth in 2024.

Real estate tokenization already valued at $30B+ in value driven by fractional ownership (See image below).

@BlackRock's RWA BUIDL fund surpassed $500M within three months of launch.

Tokenized securities expected to surpass $4–5 trillion by 2030 as per Citigroup (@Citi)

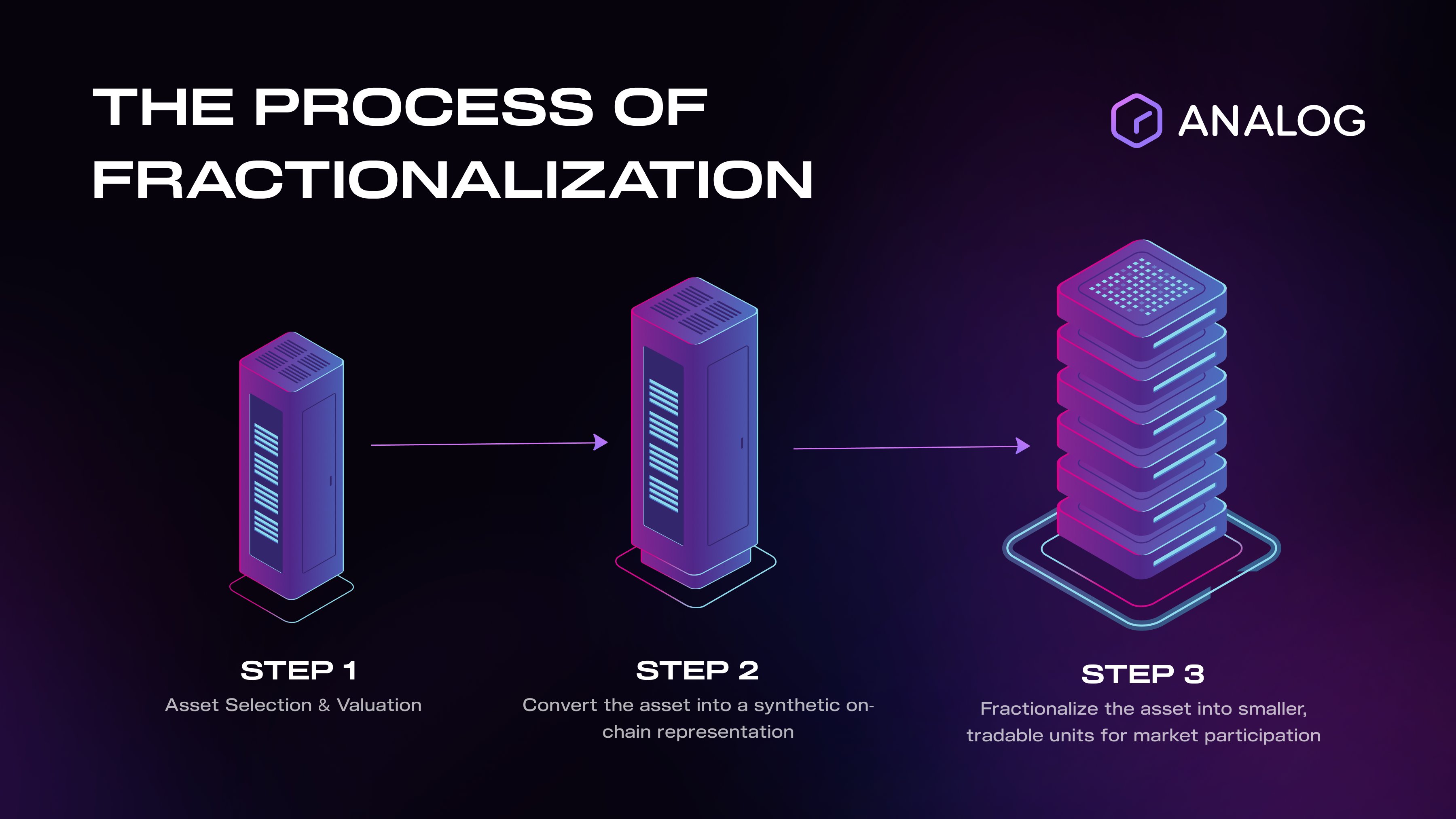

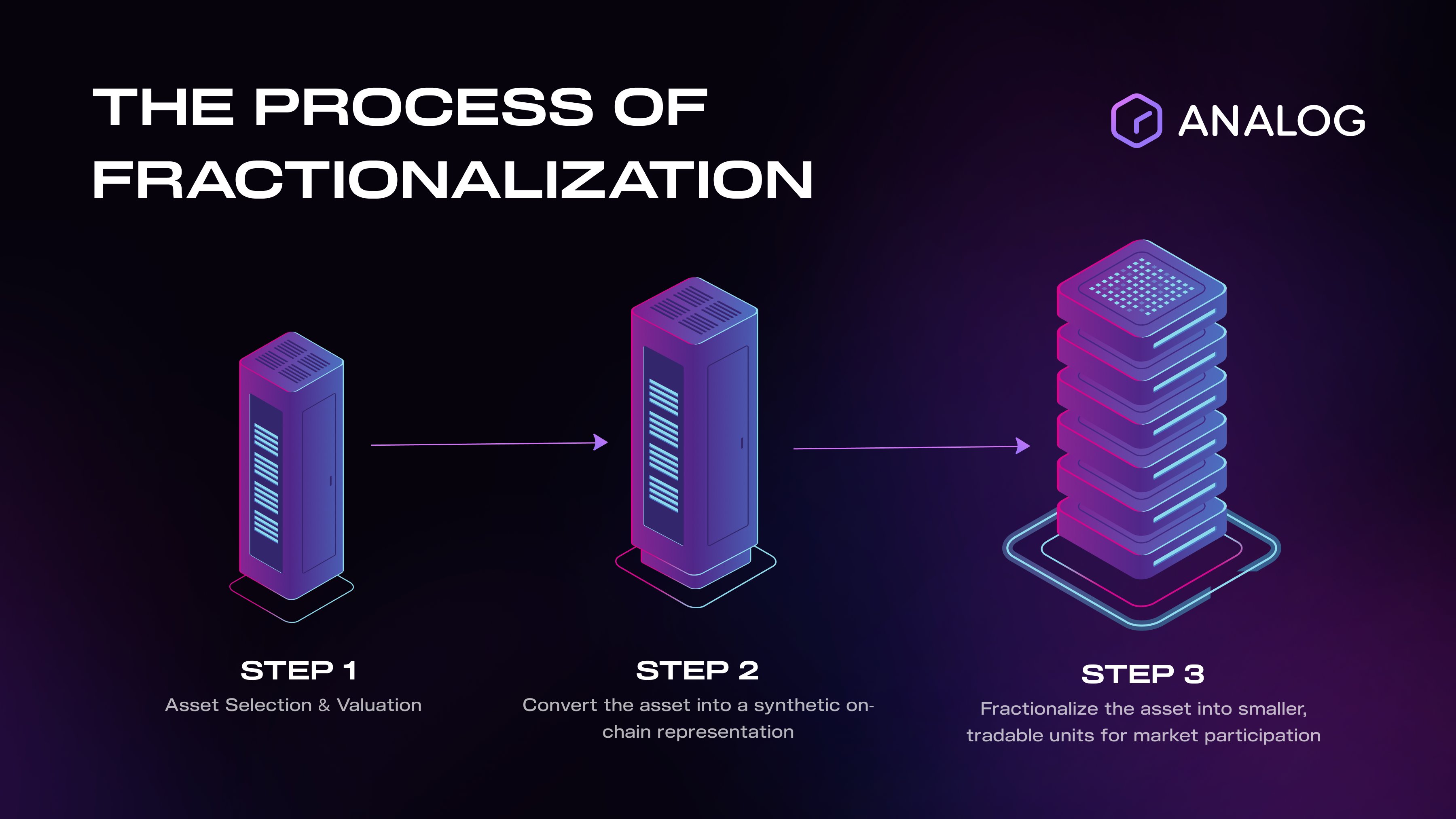

Graphic displaying how real-world assets are tokenized, turning them into digital tokens that enable fractional ownership and easy trading on-chain.

Graphic displaying how real-world assets are tokenized, turning them into digital tokens that enable fractional ownership and easy trading on-chain.

The potential is massive, but the current bottleneck is that industry isn’t there yet. Liquidity fragmentation remains one of the most pressing challenges for RWAs.

Without cross chain liquidity access , capital efficiency suffers, price discovery is limited, and market depth remains shallow which prevents RWAs from realizing their full potential as a global financial instrument.

In this report, we’ll walk through where the RWA industry stands today, what’s limiting its growth and what we can do for it to reach its full potential.

Where Are We Now With RWAs?

Right now, the RWA market is growing fast. Estimates vary, but the market size of tokenized assets (outside of stablecoins) is likely in the range of $15 to $20 billion as of early 2025.

Big players are starting to get involved. BlackRock, for example, launched BUIDL, a tokenized money market fund in 2024, that’s already managing over $500 million.

Other projects, like @OndoFinance and MakerDAO, are tokenizing assets like loans and real estate, bringing in hundreds of millions more.

Legally, the United Arab Emirates (UAE), particularly Abu Dhabi, is emerging as a leader in RWA regulation. The Securities and Commodities Authority (SCA) recently introduced draft regulations for security and commodity token contracts. Dubai's Virtual Asset Regulatory Authority (@varadubai) is also actively shaping the industry, helping to de-risk Web3 activities and attract institutional players.

What’s Holding RWAs Back?

With all this progress, RWAs still face roadblocks. Some of these are technical and others legal, but the real bottleneck? Liquidity.

Right now, tokenized RWAs are stuck on the chains they’re issued on. If a bond is tokenized on Ethereum, it largely stays within @ethereum 's DeFi ecosystem.

If a real estate asset is issued on @solana, it can’t seamlessly tap into Ethereum’s liquidity, and vice versa.

This fragmentation forces users into inefficient, high-friction workarounds:

Centralized bridges

Wrapped assets

And manual asset swaps

All of which come with cost, complexity, and security risks (like the Wormhole hack in 2022).

The numbers make this clearer. The combined market cap of Ethereum, Solana, and other leaders like @0xPolygon exceeds $600 billion, yet RWAs remain locked within their respective chain silos, unable to access the full scope of decentralized liquidity.

Until this problem is solved, RWAs will remain a fragmented, underutilized market. With a projected $30 trillion opportunity on the line, the industry can't afford to let liquidity inefficiencies like this hold it back.

The Solution: Unlocking a Unified RWA Market

For tokenized RWAs to reach their full potential, the industry must solve liquidity fragmentation at its core.

The key? Creating an infrastructure where tokenized assets aren’t confined to individual blockchains but can move seamlessly across networks, tapping into global liquidity in real time.

This means replacing the current patchwork of isolated chains with a unified system where RWAs can be issued, traded, and utilized across multiple ecosystems without friction.

Achieving this requires:

Seamless Cross-Chain Transactions: RWAs need the ability to move across blockchains without requiring centralized bridges or wrapped assets. True interoperability would allow a tokenized treasury bond issued on one chain to be collateralized on another, improving capital efficiency and expanding market access.

Unified Liquidity Hubs: Instead of liquidity being fragmented across different versions of the same asset on multiple chains, a connected system would allow RWAs to draw from a singular, deep liquidity hub. This means a tokenized security wouldn’t have separate, inefficient markets on Ethereum, Solana, and Polygon, but rather one integrated market accessible from any chain.

Standardized Data & Oracles: Interoperability isn’t just about asset movement; it’s also about ensuring price consistency and accurate valuations across chains. A robust oracle network is needed to sync real-world asset prices across different blockchains, preventing discrepancies that lead to inefficiencies.

Composability with DeFi: For RWAs to integrate fully into the digital economy, they must be able to interact with DeFi applications across multiple networks. Whether for lending, collateralization, or trading, an interoperable system would allow RWAs to function as core components of a broader financial landscape, rather than isolated assets with limited utility.

Once this infrastructure is in place, the impact will extend far beyond RWAs.

A truly cross chain Web3 doesn’t just unlock liquidity: it legitimizes blockchain technology as a viable foundation for both DeFi and TradFi.

Wrapping Up

As of 2025, tokenized RWAs are gaining traction, but liquidity fragmentation remains a major barrier to widespread adoption. To unlock the $30 trillion opportunity, the industry is in need of a universal liquidity hub for assets like RWAs to tap into.

With clearer rules, better tech, and better liquidity access, RWAs could transform how we own and trade the world around us. But for now, it’s about laying the groundwork and watching where it takes us next.

Web3 has still much to show to the world and with opportunities like these, it seems that it's impact is only just beginning.

So if you're looking to stay ahead of developments in RWA tokenization, follow @OneAnalog to stay on top of how this transformation is unfolding.

See you on the next one.